The 1031 exchange rule was not there at the time of Benjamin

Franklin. This is the reason that he believed in the inevitability death and

taxes. While the death is certain, 1031 exchange rule can surely save you from

taxes if you are doing real estate business.

The IRS

According to the Internal Revenue Code, Title 26, Section

1031, “No gain or loss shall be recognized on the exchange of property held

for productive use in a trade or business or for investment if such property is

exchanged solely for property of like-kind which is to be held either for

productive use in a trade or business or for investment."

In this scenario, the like-kind property actually means

other real estate. It doesn’t really mean that a deal must be based on land-for-land

or office-for-office exchange.

It also means that if your property exchange qualifies for

the 1031 exchange rule, you will either have no or limited tax to pay at the

time of exchange. Good thing is that you can do 1031 for as many times as you

get provided that you qualify for it. You may also be able to get profit on

each swap. However, you will have to pay taxes if you are selling the property

for cash.

Keep swapping

It means that you can actually sell an investment land to

get an office rental property. The difference of price is going to be like a

profit for the one giving high valued real estate. However, there are a few

things that you need to keep in mind.

- Investor must be selling the investment property. This rule doesn’t apply on residential properties.

- The exchange should of the properties of like kind. It means that any other real estate can do.

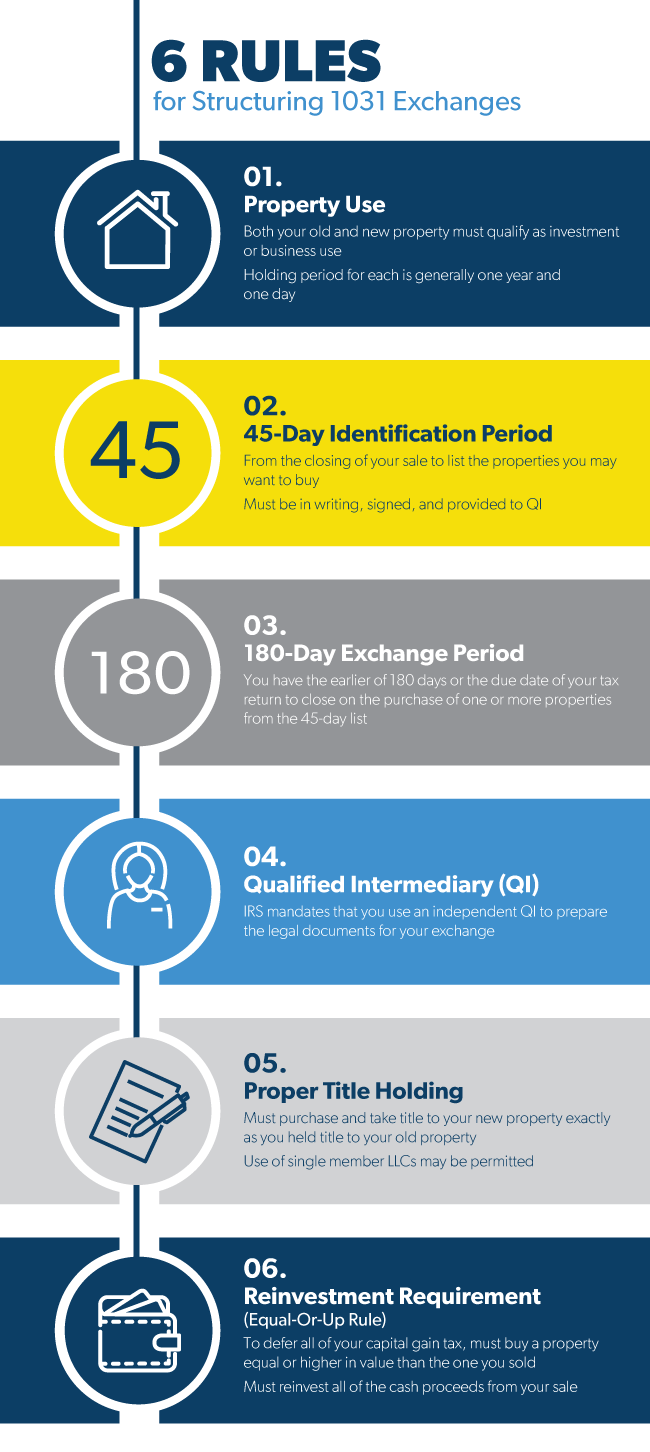

- The exchange should be done by meeting certain deadlines and time frames.

Things you cannot do

There are certain restrictions for certain properties and

scenarios here. There cannot be a 1031 exchange for:

- Properties that are held for resale and stocks in trade

- Bonds, notes and stocks

- Evidence of indebtedness

- Certificates of trusts

Government as your partner

If your property qualified for a 1031 exchange and you have

taken care of all of the deadlines and time frames too, then you can grow your

holdings by making government your partner. With an increase in the value of

properties in business, you can trade for high valued rentals while avoiding

taxes. This way, you will be able to plow the money into the next transaction

instead of paying taxes from it.

No comments:

Post a Comment